This article is a quick summary of technology trends in the Construction industry. It addresses the simple questions of What, How and When will launch Construction into the digitalized era and increase productivity, a matter which has been of concern for many decades in the industry. Technology trends highlighted in the article are based on the JBKnowledge 6th Annual Construction Technology Report, which surveyed more than 2,600 Construction leaders in the industry.

Low application of tech in Construction: reasons and constraints

Given that the AEC (Architecture, Engineering, and Construction) sector is one of the oldest industries on Earth, it is no surprise that it has been slow to adopt emerging technology. What is more surprising, there are still challenges to face when it comes to dealing with the basics:

- Communication and project planning remain uncoordinated between the field and the office.

- Contracts with owners often do not include shares allocated to innovation and R&D.

- Poor organization and decision making processes do not have the necessary response speed, and supply chain approaches are still behind other industries.

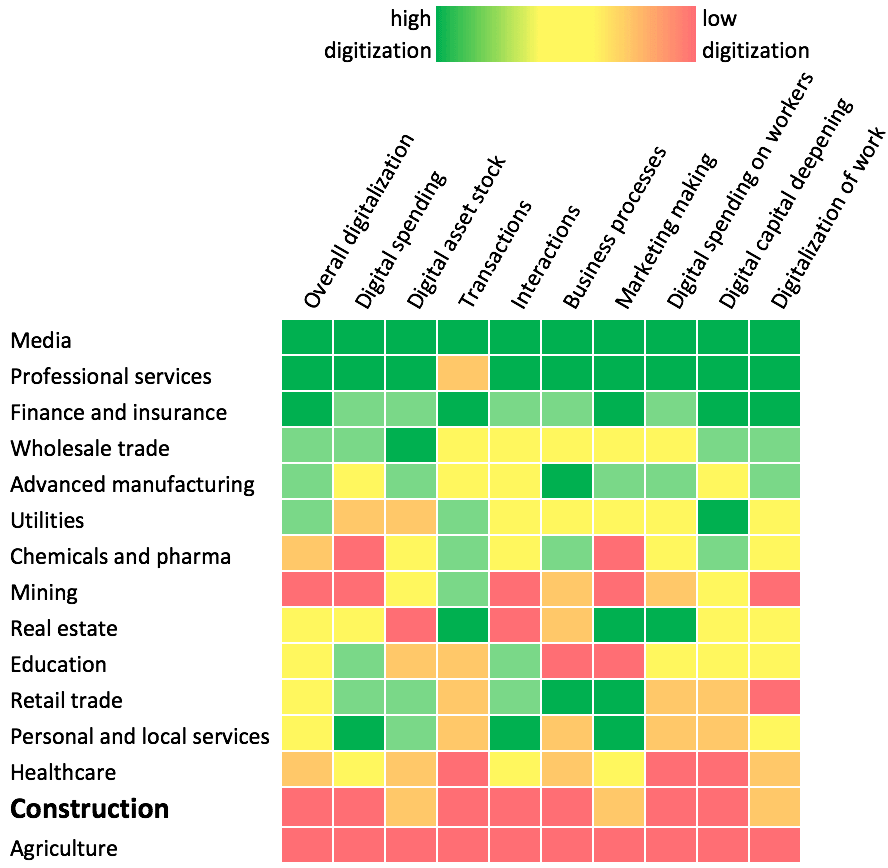

In the McKinsey Global Institute Industry Digitization Index, the Construction industry is at the end of the list:

The Construction industry has yet to embrace the fact that most of the emerging digital technologies which deliver significant long-term results need up-front investment, even though innovations like AR (augmented reality) could bring benefits to the Construction site right away, according to MIT Technology Review.

In Construction, R&D and IT spendings are far behind other industries: less than 1% of revenues for R&D compared to 3.5-4.5 % for the Auto and Aerospace industries, and 8% in the Telecom sector. The same numbers apply to IT resources allocation.

The JBKnowledge Construction Technology report sheds light on this:

- Roughly half of the respondents do not bill any IT expenditures to projects; only 31.1% bill to projects, depending on expenses. This will continue to be a problem unless key stakeholders in the construction process achieve consensus on how to quantify the ROI of technology in hours saved, efficiency created, materials not wasted, etc.

- The majority of survey participants spent less than $500,000 on any form of IT annually. Still, the number of companies spending less than 1% of annual sales on IT has decreased by 9% over the previous years. This indicates that more companies are realizing the value of dedicating funds to IT and the need to plan for technology upgrades.

- The dependence of billing on the scale of the job was a frequent comment. This indicates that both technology vendors and AEC could benefit greatly if the pricing models would be more dependable on the job scale.

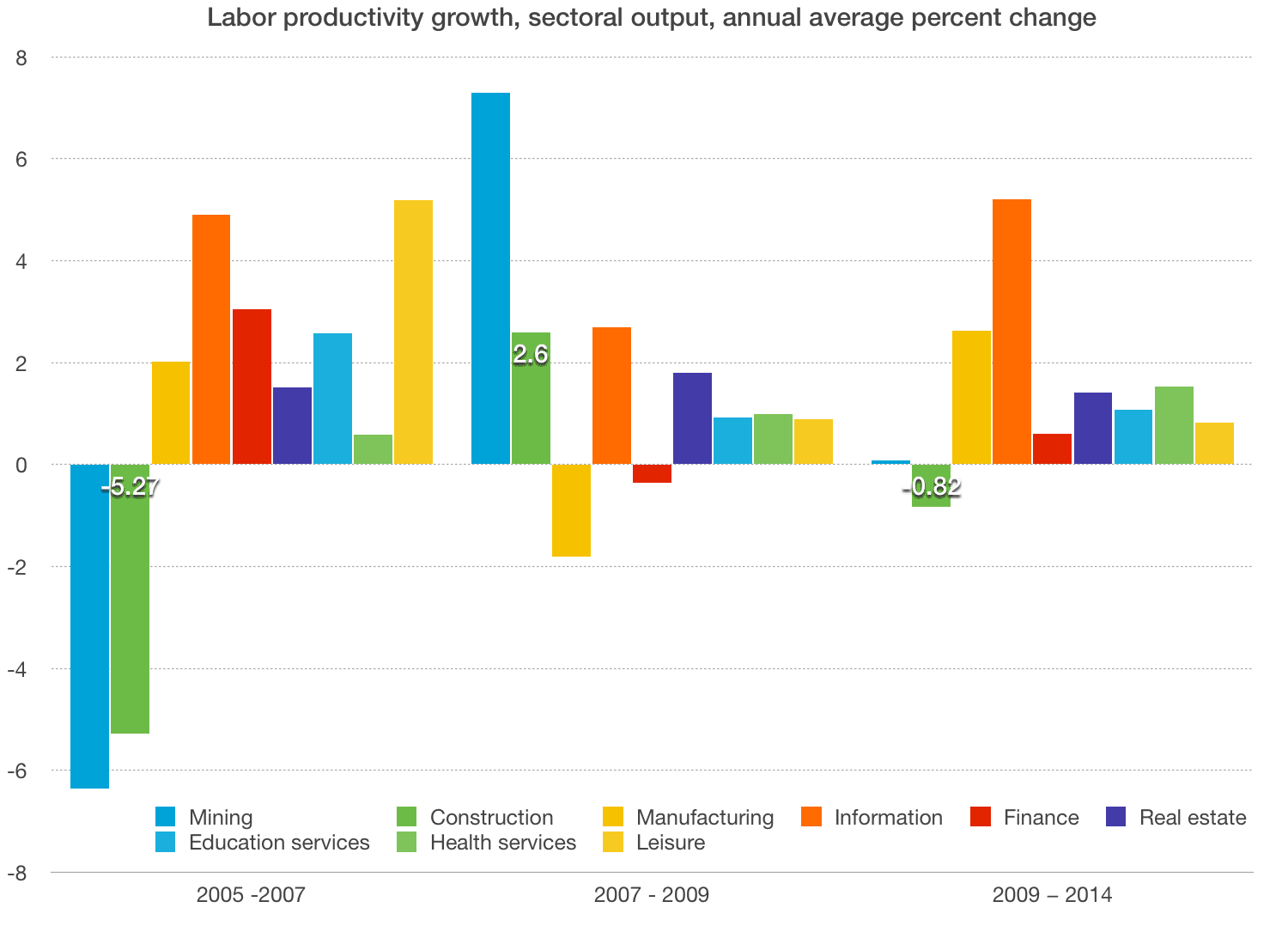

According to McKinsey partners Jonathan Woetzel, Mukund Sridhar, and Jan Mischke, the global Construction industry has a chronic productivity problem. Over the past 20 years, productivity has grown at only 1% annually, which is around one-third of the rate of world economy and one-quarter of the rate in manufacturing. This is partially due to the low application of innovative technologies and poor implementation of them into work routines.

Based on data from U.S. Bureau of Labor Statistics and U.S. Bureau of Economic Analysis.

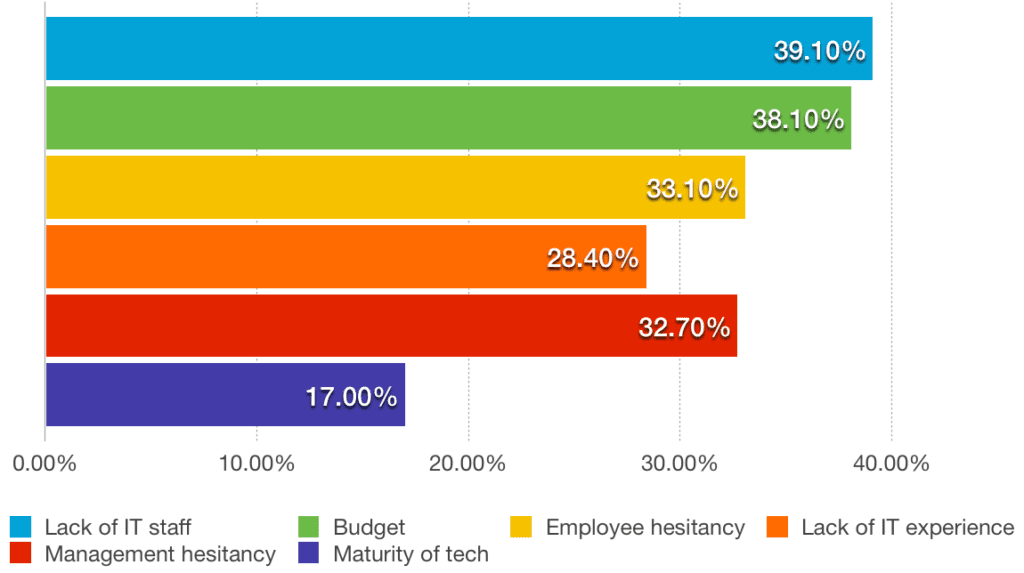

According to JBKnowledge annual Construction and Technology report, the low application could be explained by the following factors:

The Employee hesitancy factor replaced the previous year’s third most prominent reason, Management hesitancy. Presumably, this shift is a result of Construction companies’ management finally seeing the value in technology (including AR for construction) and R&D investments. Still, since a fair amount of time has passed, the people employed in Construction are now fairly attached to their current routines and tools.

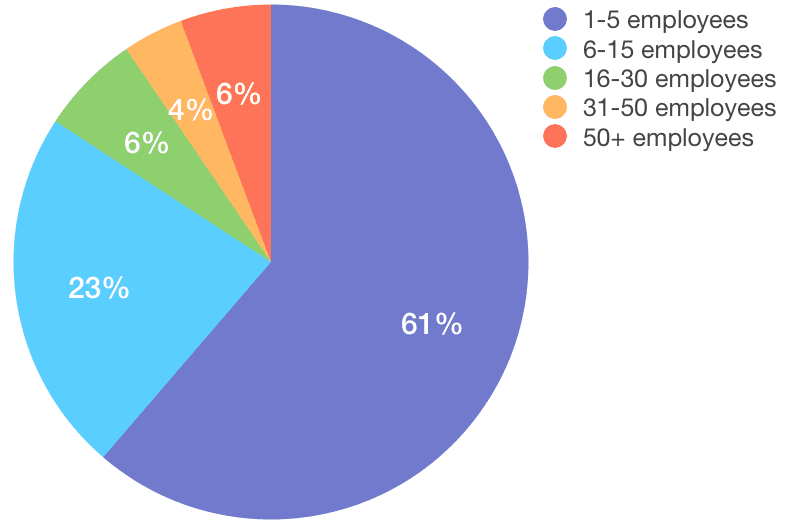

Interestingly, the survey participants who said they were willing to try everything were coming from the smallest companies surveyed (51-100 employees). Smaller companies have enough people and processes to risk trying new tech to improve efficiency. They are also more open to researching, developing, and testing new technologies — it only takes one champion to put an emerging technology on the radar at a smaller company.

Nevertheless, the report also outlines promising software solutions for AEC and defines the opportunities that new technologies provide, especially in the field of drone technology (the most popular emerging technology of 2017). Unsurprisingly, AR and VR (virtual reality) are in the top 5 next-gen tech that construction companies are trying; AR also gained 50% in popularity since the previous year. One key reason for the popularity of augmented reality in the field of Construction business is the unprecedented potential for making huge savings on reworks: according to Norwegian Road Authority, the average cost per change/conflict has been calculated to be about $9600. The emerging technology allows engineers to build the right thing at the first attempt and helps to significantly improve different aspects of the construction process (you will find out about potential use cases for augmented reality in Construction further on).

IT departments are growing, but are still too small

Good construction depends on IT providing means for collaboration, coordination, and integration of input information across different departments, engineering modelling methods, and model-based analysis. This requires an established IT department which can handle all of the needs of the Construction team.

The current state of IT departments reveals that most companies do not understand the full potential and value that technology can bring to the field yet. Research from JBKnowledge shows that only around 50% of the companies surveyed have a dedicated IT department.

However, roughly 35% of companies had expanded their IT departments compared to the previous year, and only around 5% of companies downsized employees in their IT departments.

Having a fully established IT department allows construction companies to handle the implementation of sophisticated software solutions like Construction AR more successfully, as the department is part of the company.

Hopefully, the Construction industry will see an increase in IT staff in 2017, compared to 2016. Respondents reported the following factors of managing the size of IT departments:

- Total number of employees.

- Number of technology solutions.

- Size of projects affecting the number of IT employees.

Though the conclusion that companies are starting to see the value in technology and establish corresponding departments to handle the implementation is clear, there is still a lot work to do in terms of aligning corporate objectives and strategy-based budgeting as a more accurate method for determining company’s IT needs.

Benefits of cloud-based solutions for Construction

A decade has passed since the Construction industry began using cloud solutions. How to they aid the AEC? Leveraging cloud-based services extends the possibilities for collaboration between owners, contractors and other parties; provides real time accessibility to data and cuts the need for physical storage; as well as allows to cut cost, dramatically and immediately.

Construction companies have a long history of fearing “the cloud” for security reasons. The biggest concern is the danger of data breaches (and companies providing their cloud-based solutions should address this to be competitive on the market). Some managers in the Construction industry are already beginning to see the benefits of these solutions, while others now understand that cloud-based storage is in fact more secure than on-site servers.

Going forward, more and more companies are getting to grips with the idea that cloud-based apps are more reliable in terms of uptime, security, and adding computational resources to their servers.

With further growth in cloud-based solutions usage, we will see Construction companies discovering other software solutions (as well as augmented reality for construction) that are available only in the cloud. As a result, AEC will reap many benefits and facilitate the growth of new tech startups.

BIM usage is increasing, but it still has a long way to go

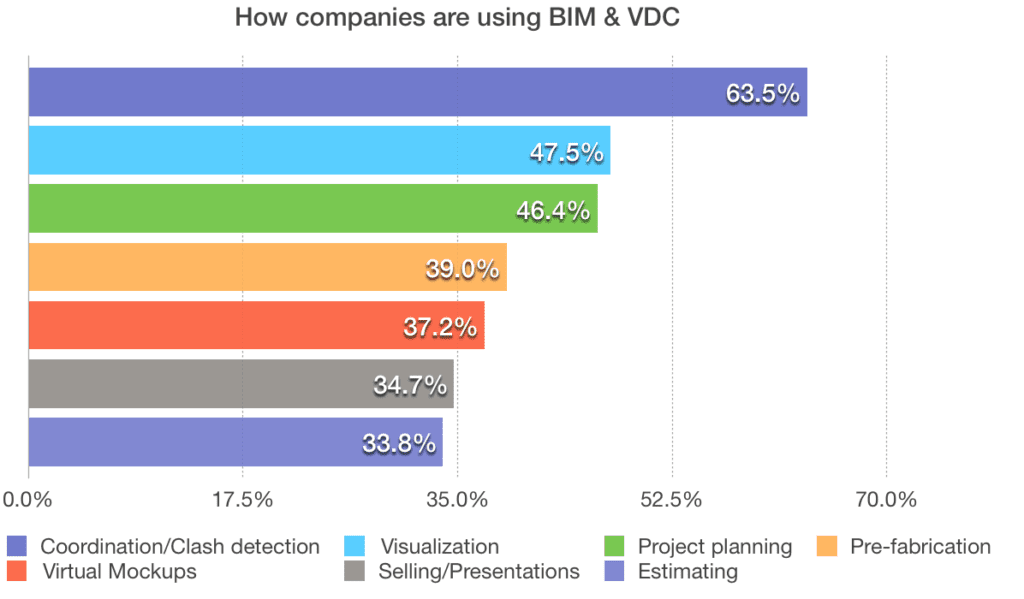

According JBKnowledge, roughly half of the companies feel fairly confident that they can maximize BIM (Building Information Modelling) and VDC (Virtual Design and Construction) workflows. Many companies are combining IT, BIM, and VDC departments into Construction Technology departments for closer collaboration.

The number of engineers who do not use BIM has fallen by 30% in 2017, compared to 2016. The net increase in BIM usage signals that more companies are dipping their toes into VDC waters (whether internally or through outsourcing) — as well as recognizing the value added in streamlining design, clash detection, and scheduling in the pre-construction process. The majority of professionals agree that BIM is the future of the AEC industry, especially as more and more owners now require BIM. However, many are still struggling to make the transition from traditional CAD to BIM, as BIM requires extensive training and significant expenses in the beginning.

Further BIM expansion among companies will allow more AEC professionals to look into the emerging AR solutions that allow the display of actual models of the buildings over the real construction site.

The main stumbling blocks for BIM adoption are:

- Lack of training.

- Lack of understanding of the BIM ROI by the client.

- Lack of resources allocated to IT.

“The owners want BIM, but are not willing to foot the bill for it, even though it would save tons of money in labor and material,” says Dan Calloway, an electrical engineer with thirty years of experience in the field. The nature of the technology will not make design teams uncomfortable, and it is only a matter of time before clients realize that BIM is a useful tool that can significantly cut business costs.

Respondents also shared their opinions on where in the construction process they think BIM and VDC will add the most value in Construction in the next decade, and where both hold the greatest potential for bridging the gap between design and construction. The most common responses included:

- On-site 3D Coordination and Scheduling.

- Design Review.

- Existing Conditions Modeling.

Additionally, respondents highlighted wearable technologies, mobile computer connectivity, and ease of access to on-site information as areas with high perceived future value that are worth exploring further. This brings us closer to augmented reality for Construction industry.

Mobile and wearable devices gain traction

The Construction industry is entering the “mobile revolution” — mobile apps are becoming more and more popular for construction workflows. There has been a drastic shift in the usage of mobile applications and wearables since 2012 in Construction industry.

The report found that the share of respondents who considered mobile tech to be unimportant has decreased roughly by 20% points. More interestingly, those who were born 1960 through 1970 responded to this question in almost the same manner as the other age groups surveyed. This means that not only millennials understand the importance of adopting the latest software.

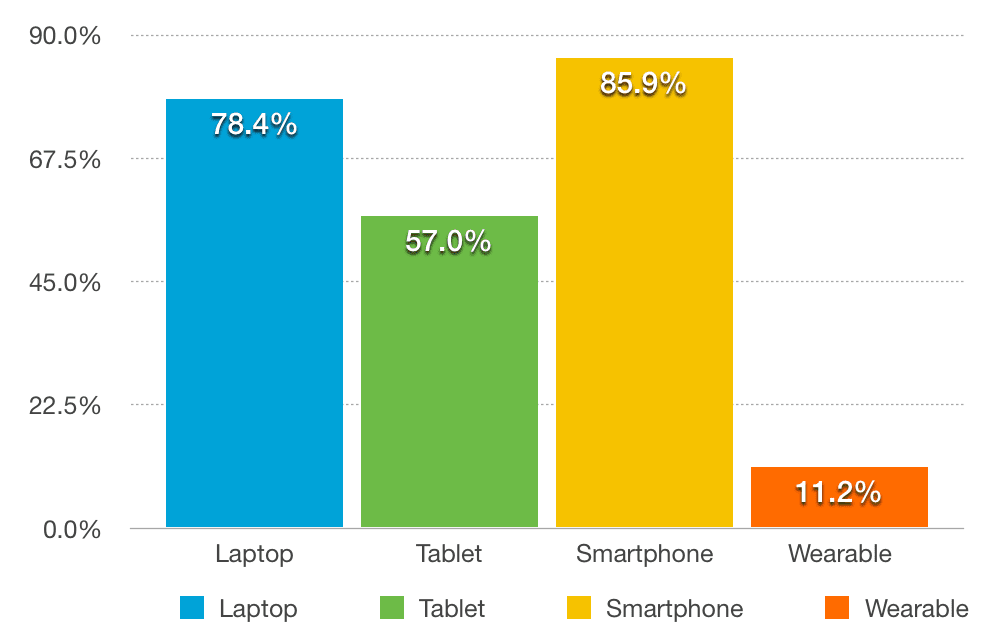

According to the JBKnowledge, the following numbers represent daily mobile and wearables usage through 2017:

While adoption of wearables has increased by 10%, most construction workers are still using their own devices (around 70% of workers). This can be an to obstacle to emerging AR solutions: the majority of advanced AR headsets (like Microsoft Hololens) are still too expensive for personal use.

Hopefully, mobile devices can still allow for AR experiences (though less sophisticated compared to the possibilities of advanced AR headsets). In the answer to the question about mobile operating systems in use, one survey participant commented that he is starting to tinker with the recently released mobile AR development kits (Apple’s ARKit and Android’s ARCore) because they allow developers to easily incorporate augmented reality capabilities into their mobile applications. This indicates the rising interest of those employed in Construction industry towards AR solutions. That being said, the use of augmented reality in construction will dominate over the use of VR.

Growth of AR Solutions in Construction

Nearly 65% of builders say that, on a scale of 1-10 (10 being “Very Comfortable” with new technology), they are at least at 8. Further numbers indicate that the Construction industry is ready to embrace new technology — the top four responses were between 7 and 10. Now, the industry needs to address the looming questions of deciding on an implementation strategy, who will own the process, and how to calculate the returns to get budget approval.

Virtual and augmented reality in construction uses almost doubled in 2017 compared to 2016, from 7,4% and 7,1% to 12.8% and 12.7%, respectively. As companies like Microsoft are applying their immersive headsets across different industries and developers coming up with more user-friendly solutions, we will see more and more AEC companies adopting AR technology. According to VRFocus, the UK Government is also investing in VR and AR for Construction to back up the rising interest in the technology.

Other noteworthy investments that were made in tech related to virtual and augmented reality in construction:

| Company | Money raised | Date of the funding round |

| IrisVR | $9.73m | Oct, 2016 |

| Holobuilder | $2.92M | Mar, 2017 |

| Occipital | $21M | Jul, 2015 |

| Pandora AR | $1M | Sep, 2016 |

| InsiteVR | $1.5M | Aug, 2016 |

| ScopeAR | $2.12M | Jul, 2016 |

Augmented reality solutions present phenomenal advantages for the Construction industry. AR applications are able to see and interpret the external world in real-time in order to project images onto it. Microsoft has already released a proof-of-concept for an application for its HoloLens headset: the device will help guide construction projects and eliminate the need for physical blueprints. Other companies are also launching their products to tackle different AR Construction cases.

How is augmented reality in Construction revolutionising the industry?

Now, let us finally take a close look at the ways of how the Construction industry could benefit from AR technology. Below you will see examples that are already on the market, and harbor the potential to bring crucial value to construction projects.

Overlaying BIM (and design) models on top of the real world

How does AR Construction work? A Construction industry manager or contractor puts on a dedicated headset to do a walk-through of a site while viewing an overlay BIM model on top of the physical world, to assess and compare changes and review project documentation. They would also be able to instantly take pictures or record a video of their AR walk-through and send it back to the design team for clarifications.

The benefits of augmented reality in Construction:

- Fewer reworks, as augmented reality solutions help provide blueprints on time.

- Lower downtime, as AR allows to perform quality assurance right away.

- No loss of crucial details during conversion, including remote communications between design and on-site teams.

- Lower reworks and downtime costs.

- Higher productivity — AR headsets are easy-to-use tools that allow for quicker construction process, a dramatic improvement on traditional tape measures and total stations.

- Smart Instructions in AR construction

By transforming traditional paper-based work instructions into Smart Instructions (instructions virtually overlaid onto physical objects when using an AR headset or any mobile device), users are immersed into three-dimensional, animated, and intuitive computer-generated imagery that is positioned on top of the real world.

Benefits of Smart Instructions:

- Lower training costs.

- Improved quality of instruction materials.

- Allows workers to work faster and without errors.

Remote augmented reality in construction

Remote AR is a one-of-a-kind collaboration tool that allows remote field technicians and experts to connect via live video, audio, and a powerful annotation toolset that is superimposed onto the real world.

Users place annotations and 3D models in a shared video and stay locked onto the real world, giving rich context and eliminating confusion. No matter how users move around, their annotations will remain in place, ensuring their message and intent is never lost.

Benefits of Remote AR:

- Allows to make the right decision faster.

- Minimizes downtime by allowing anyone from the crew to handle an issue.

- Increases service revenues.

- Maximizes customer satisfaction by bringing the best talent to the field remotely.

- Cuts travel costs.

- Scales expertise around distributed teams.

As a result, Remote AR is set to become one of the most sought-after AR construction services in the industry.

Afterthoughts

AEC is one of the most information-heavy industries, and all of its major processes require extensive data communication between parties. Construction companies must utilize cutting-edge technologies in order to break the cycle of unproductivity and achieve the quality, cost, and timeline goals of construction projects. Here, the use of augmented reality in construction is poised to become the prime facilitator of the industry’s transformation, due to its immense practical benefits. It is clear that the change is on the horizon: IT has already automated processes across many industries and has fundamentally changed the way the businesses operate. Although there is still a number of obstacles to overcome and many outdated processed to optimize, the survey conducted by JBKnowledge has shown that the usage of IT in Construction is growing steadily.

If you already decided to elevate your construction business with AR, or need an extensive consultation on the matter, get in touch with our AR Construction expert.