Modern Auto Insurance Sector: How the Idea of Auto Insurance Estimating Software Appeared?

It can be already stated that the COVID-19 outbreak transformed the auto insurance sector dramatically. The inability to offer insurance services in an old-fashioned way during the overall lockdown made some market players turn to use auto insurance software instead. Indeed, this decision created the stimulus for the whole sector to change.

If everything goes smoothly, we can witness what a revolution enforced auto insurance estimator software can cause! But before that happens, let’s see what exactly this new trend promises.

Auto Insurance Software: Emerging Technologies and Changes They Bring

The involvement of up-to-date technologies in the auto insurance services sector causes three main directions of changes to appear:

- Facilitation of the communication between the key players via specifically designed auto insurance software.

- Raising the level of expectations and the ability of an insurance company to manage them.

- Optimizing expenses of repairment with a fast and cost-effective auto insurance estimating software.

All these achievements can be summed into one and most important achievement. All the new tools make it easier for customers to engage and interact with their insurance companies.

Top Achievements of Auto Insurance Solutions

Car insurance software solutions and driver insurance software solutions

The area of car insurance software solutions is developing dynamically. In this line, the cargo insurance software is a brand-new way to maintain your automobile and apply cost-effective repair if needed. As an essential trend in this process, driver insurance software solutions are summed in the human-centered approach for insurance. One of its examples is tracking their behavior to propose the most suitable insurance plan.

Broker Auto Insurance Software Solutions

As for broker auto insurance software solutions, several cloud-based platforms that facilitate their work, in the contemporary market, various apps enable efficient reporting and analytics collecting. In general, this subcategory of auto insurance software solutions is one of the most promising and well-developed today.

Auto Insurance Quote Software and Auto Insurance Claims Software

Like broker auto insurance software solutions, the cloud technologies that process quotes and claims have great potential in the future. In particular, auto insurance quoting software creates the digital space for interactions between customers and agents that results in a faster and more effective quoting process. Moreover, this subcategory improves the quality of customer experience significantly.

Auto insurance claim management software works in a similar way. Referred to as auto insurance claim handling software, this category of solutions works on fixing various issues connected with client retention. It assists in establishing an effective system for addressing various disputes and requests quickly and successfully by offering an automated app for workflow management.

Auto Insurance Rating Software

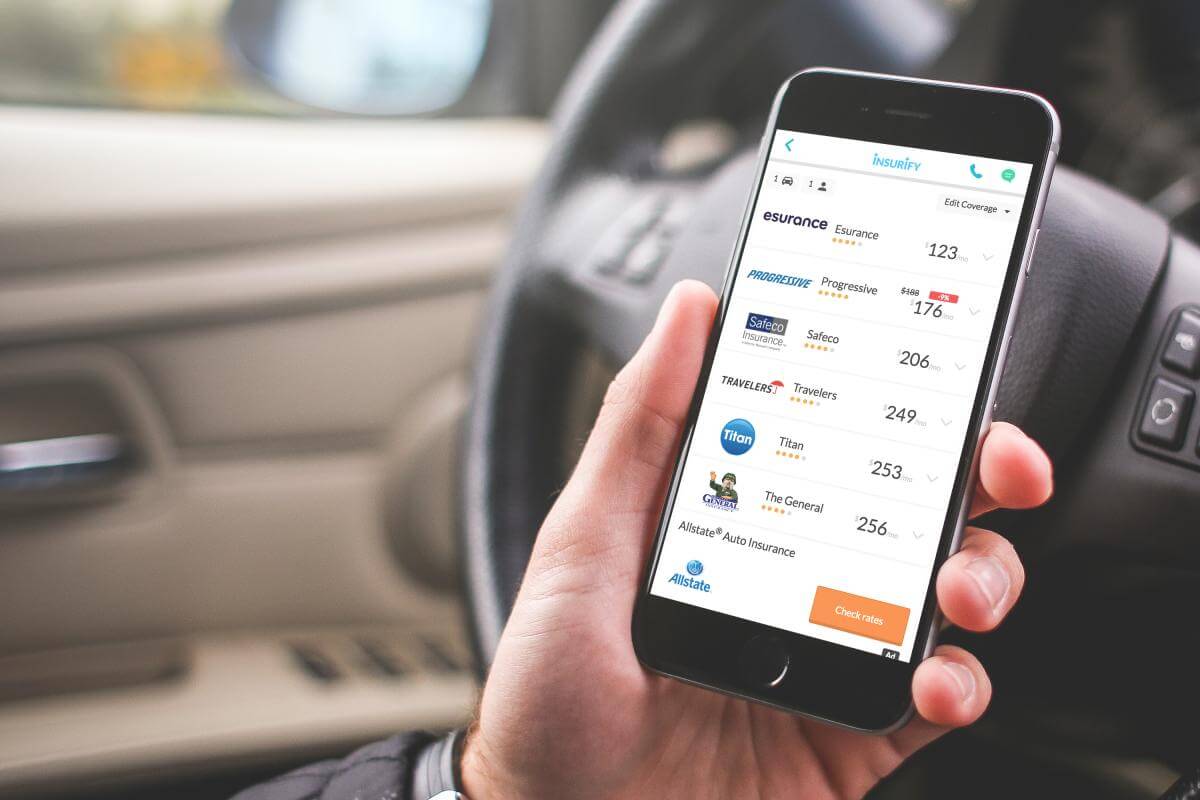

The niche of auto insurance rating software aggregates all the available solutions on the market in one place. With its help, the clients can access various platforms and compare their terms and conditions for making the best deal.

Auto Insurance Underwriting Software

Finally, auto insurance underwriting software helps to manage all the processes linked with underwriting activities. Among the typical offerings, these solutions enable incorporating various prescribed rules into automated processes, simultaneously increasing team productivity and customer experience. In addition, such a digitalization introduces a significant level of flexibility in the service offered.

Challenges and Opportunities for the Development of Auto Insurance Quoting Software

In general, it’s easy to notice that the appearance of various auto insurance software solutions is called to improve the situation for both an insurance provider and a client.

On the one hand, the new technologies create all the needed conditions to manage the relationships with customers directly. These analytical and collecting tools create a digital space that helps many insurance companies work better. At the same time, some people are still not ready to exercise the complete package of all its possible services. And so, we need the proper training and awareness level to make them work.

On the other hand, the clients can feel the improved experience from their side. Auto insurance software speeds up the real-time processing of their complaints and integrates their typical interactions within one platform. Nevertheless, the low quality of technological solutions today is a significant obstacle for their perspectives tomorrow.

That’s why we, at Intellectsoft, offer our assistance in developing auto insurance software for you. In our everyday practice, we empower companies and their workforces with innovation services and approaches to help them survive during a crisis. Are you and your organization looking for an auto insurance solution?

Talk to our experts and find out more about the topic and how your business can start benefiting from it today!