Despite the competition from startups and the ever-present economic challenges, the banking industry is gradually adopting what the latest technologies have to offer. What the established industry players perceived as a threat a year ago is now viewed as a set of useful tools that enable better cost-efficiency, security, customer experience, and operational efficiency across the board.

From cloud technology to cyber risk management to machine learning in investment banking, join us as we explore the banking industry trends for 2019 and beyond.

Cloud Technology as New Foundation

Cloud has become the new normal for nine of ten enterprises across industries. The average IT environment in both SMBs and larger companies is becoming increasingly cloud-based. Companies also diversify their delivery models, with Infrastructure as a Service (IaaS) and Platform as a Service (PaaS) gaining more and more traction. Plus, a slew of new job positions have emerged to manage different aspects of cloud in the enterprise, including architecture and safety.

Cloud is one of the current banking industry trends as well. It is expected that the technology will serve as a foundation for core modernization of banking organizations.

Cloud will provide the industry with a slew of substantial benefits:

- Data management, with storing and processing capabilities

- AI-driven analytics with machine and deep learning algorithms

- Flexible migration from legacy systems to a single cloud environment

- Agility and scale: cloud allows banking organizations make changes and add new functionality quickly

One of the new trends in the banking industry, ensuring fail-safe security will also be a core question regardless of the type of a cloud solution and its scale.

Example of Cloud Adoption: Capital One is in the midst of cloud transformation, on track to move its core business processes and customer apps to cloud.

Risk Management Banking Industry Trends

Existing risk management systems at banking organizations might not be ready to face the challenges of the rapidly changing world. Poised to become the top banking industry trends for 2019 and years to come, AI-driven solutions with machine and deep learning algorithms provide a solution.

Although wide adoption and implementations poses a number of challenges ranging from ethics to cybersecurity, AI-driven analytics will be inherent to the future of risk management. Based on trained or self-learning algorithms, such solutions can find, gather, manage, and analyse data to single out risks and provide insights.

Example of AI Adoption: ANZ has created a proof of concept that incorporates deep learning techniques with customer data to access the risk better and on a more dynamic basis.

As for cyber risk management, experts at Deloitte point at the following trends in the banking industry:

1) Strengthen basic controls like IT asset, patch, and vulnerability management to identify and manage risks related to implementation of cloud and migration to open architecture.

2) Use analytics tools and AI with security in mind.

3) Build an IT infrastructure with security as a top priority: it should be able to withstand systematic attacks and long stress periods.

Retail Baking Industry Trends: From Mobile-Driven CX — to Non-Banks

Fintechs and nonbanks now have a substantial influence in the banking industry. They are highly agile, innovative, and aim at exceeding the demands of modern customers in banking services and experiences.

Established retail banks need to compete and often play catch-up. Still, they acknowledge the need to change, and change fast. Throughout 2018, retail banks across the world were rapidly embracing a mobile-centric customer experience, while investments in mobile technologies has increased significantly. Notably, Asia Pacific leads in adoption of digital banking, with constantly changing consumer demands, unbanked potential, and favourable regulation cited as primary drivers.

How to approach this new customer experiences? Modern customers have a stronger connection to established technology brands like Apple and Google than to banks they use. One of the key reasons is these companies’ ability to merge physical and digital experiences in a single customer journey. Thus, adopting the same approach is a potent solution for retail banks that aim at adopting the latest trends in the banking industry quickly and impactfully. In practice, this means improving different channels — branches, ATMs, call centers, chatbot implementation, and other.

In 2019 and beyond, the banking industry will also see more digital-only mobile banks that operate without branches. Finn by JP Morgan Chase has gained positive user feedback. UK’s Atom Bank, a startup that raised $514 million, has been operating for several years now and offers its clients savings options, mortgages and business loans. Meanwhile, major banking industry organization are likely to strike partnerships with nonbanks to cater to the demands of modern clients as well as score more image points.

While not among evident banking industry trends, branches will continue to play a key part in the customer journey — but the experience will rely on digital tools more, according to a Deloitte survey.

These tools could include:

- Virtual remote services with a bank’s representative

- Digital screen self-service with optional assistance from a representative

- Scheduling video meetings with a bank’s employees

- Branches that operate like co-working spaces, where customer can both work, communicate, and rest

Investment Banking Industry Trends — Simpler, Leaner, More Client-Oriented

There are no big surprises in the transformation of investment banking compared to the other areas. On the surface, investment banks are rapidly embracing digital technologies to become more cost-efficient and elevate the customer experience.

Still, a subtle and all-important change is in motion. According to The Wall Street Journal, the power balance is allegedly shifting to the buy side, especially to the large institutions. On top of that, commoditization, price competition, and growth in the market clout have increased the negotiating power of clients. Other challenges of current economic realities abound, prompting companies to speed up the changes in the way they operate and offer services.

The key trends for investment banking are transforming the customer engagement model to more client-centric and adopting a bespoke approach with more streamlined services, possibilities, and smart individual insights for clients.

Investment banks would also need to sharpen the focus on who to serve, what to offer, and how. In the fast-paced world of today, this would require them to become significantly more agile and use third party solutions more broadly.

Like in other areas of the industry, AI-driven solutions with machine learning will also be a major driver in the digital transformation of investment banking.

AI will help in the following:

- Improving operational efficiency

- Risk management systems (FICC and derivatives training in particular)

- Trading

- Pricing engines

- Risk management systems

- Predictive analytics

Example of digital technology adoption in investment banking: Goldman Sachs created a bond-pricing engine that processes transactions of up to $2 million without human involvement.

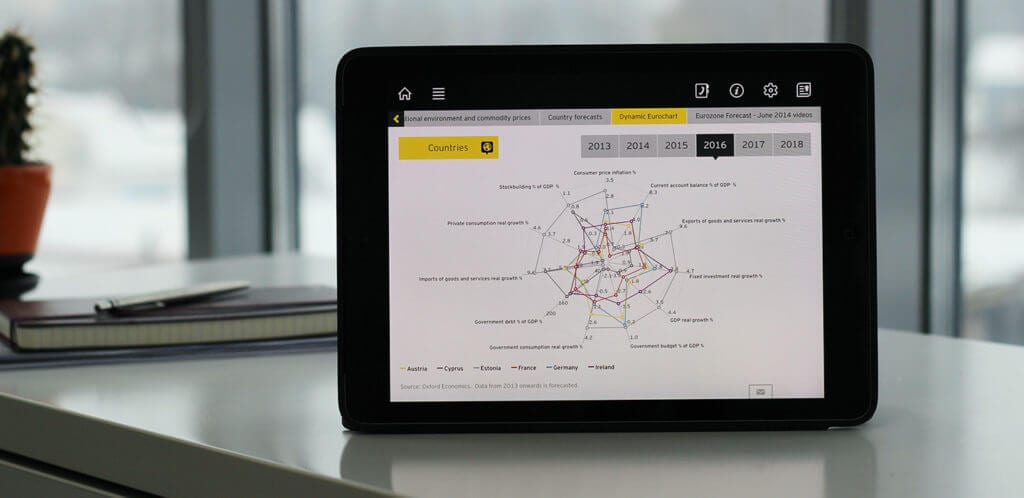

Ernst & Young — Digital Transformation Case Study

The Challenge

EY approached us with a need to strengthen their reputation for thought leadership in the world of finance and banking by providing industry professionals with a consistent stream of educational materials and opinion pieces. The solution needed to present content in a digestible but comprehensive way as well as make EY stand out from the competition.

The Solution

We created a mobile solution called Forecasts in Focus for iPads. Our experts crafted a comprehensive and simple-to-use CMS that allows EY’s editors to upload copy and media materials easily as well as customise their interfaces with reports, geolocation updates, and webcasts.

The Impact

The solution significantly reduced the time for content publishing and management while providing EY’s editors with a comfortable media tool. Second, Forecasts in Focus helped EY create a consistent brand voice online. Finally, financial experts now can count on EY to deliver engaging content and actionable insights on-the-go and in an eye-pleasing way that supports the brand’s reputation.

Need a consultation about software and technology efforts for banking organization? Get in touch with our experts.