Nowadays, the insurance industry, beyond any doubt, is encountering one of its most profound changes in decades. Though incumbent insurers benefit from institutional knowledge, stable cash flows, etc., it’s still not enough to keep pace with the times.

The digital transformation in the insurance industry is implemented to solve that problem and reinvigorate the traditional system for modern society demands.

The Meaning of a Digital Transformation in Insurance

Digital transformation is a term you’ve likely already encountered, as it has already changed countless commercial industries, including the medical sphere.

The insurance industry has traditionally been slow to modernize. Still, it’s more evident than a day that it is time for insurers to accomplish digital transformation to become more mobile and easy to use.

Due to Accenture, 96% of insurers think digital ecosystems impact the insurance industry. Along with that, a variety of challenges for overcoming appear during the digitalization in insurance.

Challenges To Adoption of Digital Transformation in Insurance

Development Plan Renewing as the One of the Main Insurance Digital Transformation Challenges

To move with the times, insurers have to develop their overall innovation agenda, including the latest digital technologies. They must embrace change and rethink business models to move towards a compliant, secure, and digitally-enabled operating model to enhance customer, employee, partner, and other stakeholder experiences.

According to the BCG research, most companies are still not ready to provide the newest technologies. For example, only 36% of insurers use a central customer-data repository or CRM application to engage with clients.

Also, only 64% have mobile apps. Most of them rely on static HTML-based digital channels that do not work well on consumers’ mobile devices.

Software Changing

Instead of the traditional software with internal data centers, we can now see the emerging trends of using different cloud platforms. A great example is salesforce.com, which has established a dominant position in the customer engagement layer with a client base of more than 2,000 insurers.

The main advantage of cloud platforms is its low-cost usage-based pricing model. That is why some insurers are moving ultimately away from internal data centers to these cloud platforms.

“Be Smart” Insurance System

One of the biggest steps towards digital transformation in insurance is providing the latest digital technologies into the insurance system. The Internet of Things (IoT) services is a long-term investment in future capabilities, as connected physical objects allow insurers to interact with insured objects and their users.

Similarly, Jeff Wargin states:

“Whether it be communication, payment or even service, insurers must have the infrastructure to meet insureds where they are. Digital insurance makes that possible, with features like self-service portals, live chat, and insurance apps catering to modern consumers and making key insurance functions like policy administration, claims, and billing a nearly automatic process.”

Security Challenges as an Obstacle To Insurance Digital Transformation

The most significant benefit of digital transformation in insurance is generating and processing the sheer volume of data. Along with that, the necessity of fraud detection is one of the most demanding challenges insurance technologies have ever encountered.

Being trusted with the customer’s positive data only, the digital insurance software can help insurers search customers’ social profiles for any activity related to a claim. At the same time, predictive analytics is being used to spot customer behavior trends that might be a red flag for fraud.

In addition to the insurance digital transformation challenges mentioned above, such challenges as open ecosystems developing, big data and advanced analytics, machine learning, augmented reality, biometric identification also has massive potential for the digital insurance transformation.

Which Technologies Will Affect the Insurance Industry the Most?

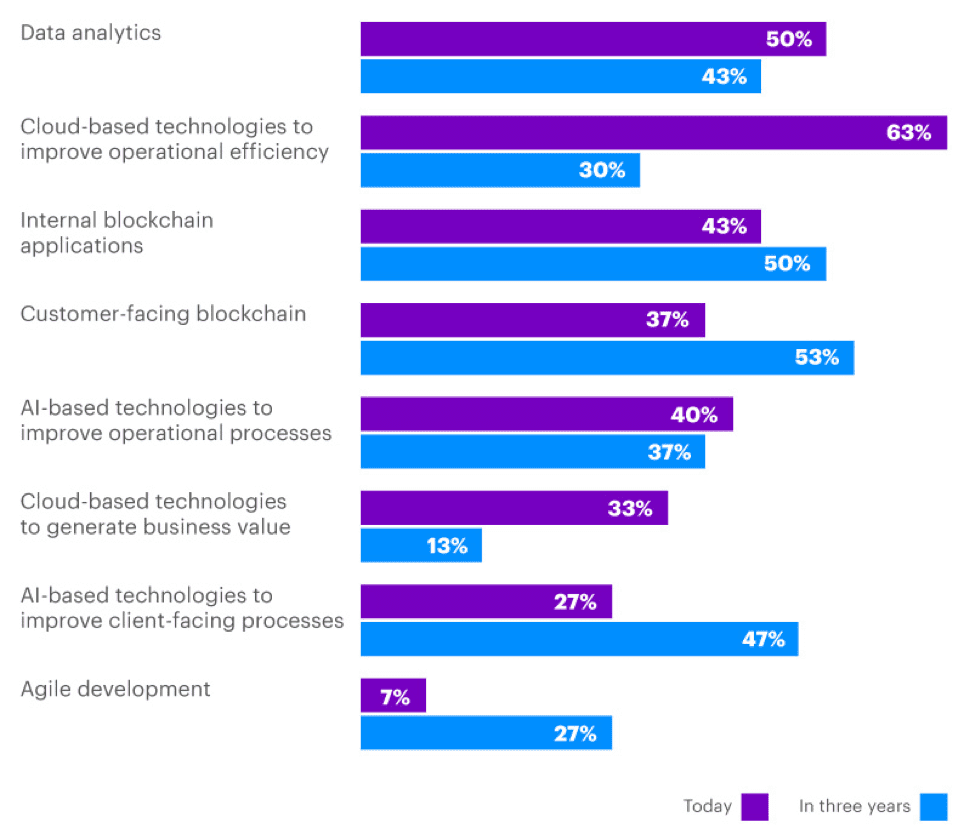

Due to the Accenture research, nowadays, the most significant impact on insurance companies is customer-facing blockchain, which protects the consumers’ data from third-party interference (53%), the second place (50%) belongs to the internal blockchain applications. Talking about the further influence on the insurance industry, we must admit that up to 2022 it will have proceeded with cloud-based technologies to improve operational efficiency (63%).

Source: Accenture

In addition to that, it is evident that agile development technology is the least influential so far, though in the nearest three years is expected to reach a 27% impact rate. And vice versa, the affection potential of the cloud-based technologies used for the business value generation is intended to lose 20% of its former rate.

How Insurtech Companies Changed the Insurance Industry?

Owing to all sorts of the newest technologies, the insurance digital transformation has made a big leap for that industry’s development. As a result, various changes have helped improve the traditional model of the insurance company.

For instance, there are some marked by RCG Global Services in their research: AdviceRobo solutions use a machine learning platform, which combines data from structured and unstructured sources to score and predict consumers’ risk behavior. Consequently, it forms the individualized risk assessment, generated on the consumer’s personal data.

To take another example, Anthemis-backed Trov creates customization of home insurance and allows the coverage of individual key items instead of the predefined set with an average payout.

App-based mobile platforms help easily collect customers’ personal information and their preferences, some details about the things users want to be insured, and the communication between customer and insurer to a higher level.

Many services and sales processes are now technology-based. For example, paying premiums, making a claim, and tablet-based sales processes in which the insurer types in some key information in the tablet and the system recommend suitable customer plans. As a result, the customer receives more and better information.

Insurance technologies have developed the broader insurance industry—not just the personal non-life space. It has also made a major contribution to the companies’ cooperation and complex automatization. Consequently, it has already started a huge process of optimizing and upgrading the entire system of insurance.

Which Insurance Fields Are Affected the Most?

Digital changes, without any doubt, affect the entire system of insurance. Significant changes can be noticed in the analytical sphere of industry.

It allows us to generate information about the customer and present the most suitable insurance offer. This article analyzes the customer service representative field, sales aspect, and application development as those spheres which have been affected the most.

Customer Services

Customer service representatives can process the information much faster thanks to the cloud services and communicate with the customers in person and on the phone, and online.

Faster communication also results in getting more details from the insured properties damaged, which improves the insurance service quality.

Sales Improvement

Significant changes are noted in the sales field of the insurance industry. Thanks to cloud services, the insurance price has considerably fallen and became much more accessible to the general public.

Mobility Development

Besides, easy-to-use applications for smartphones offer a variety of services and amenities. For example, consumers can compare the programs offered and choose the best option. They can also ensure any item right from their couch without going to the insurance company.

What Does Digital Transformation Mean for Traditional Insurance Practices?

The digital transformation has been radically changing the traditional insurance practices. For instance, The automation of claims management, policy updates, and compensation has seen tremendous digitization advancement. As a result, the insurance system became much more apparent to the new consumers and opened up some new development prospects.

Conclusion

To sum up, the digitization process in insurance fosters the changes needed to comply with the latest trends in social development. This makes it inevitable that insurance providers who will adopt early to the changing digital era will thrive by beating their competitors. And, those who will come late to the party will see their prospects plummet rapidly.

Intellectsoft has created impactful solutions for EY, the London Stock Exchange, and EuroAccident. Explore what we offer for the insurance industry.